Renters Insurance in and around Mt Pleasant

Get renters insurance in Mt Pleasant

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Racine

- Mt Pleasant

- Caledonia

- Racine County

- Pleasant Prairie

- Sturtevant

- Kenosha

- Wind Point

- Yorkville

- Somers

- Union Grove

- Raymond

- Oak Creek

- Franklin

- South Milwaukee

- Kansasville

- Burlington

- Waterford

- Wind Lake

- Milwaukee County

- Paddock Lake

- Bristol

- Franksville

- Muskego

Home Sweet Home Starts With State Farm

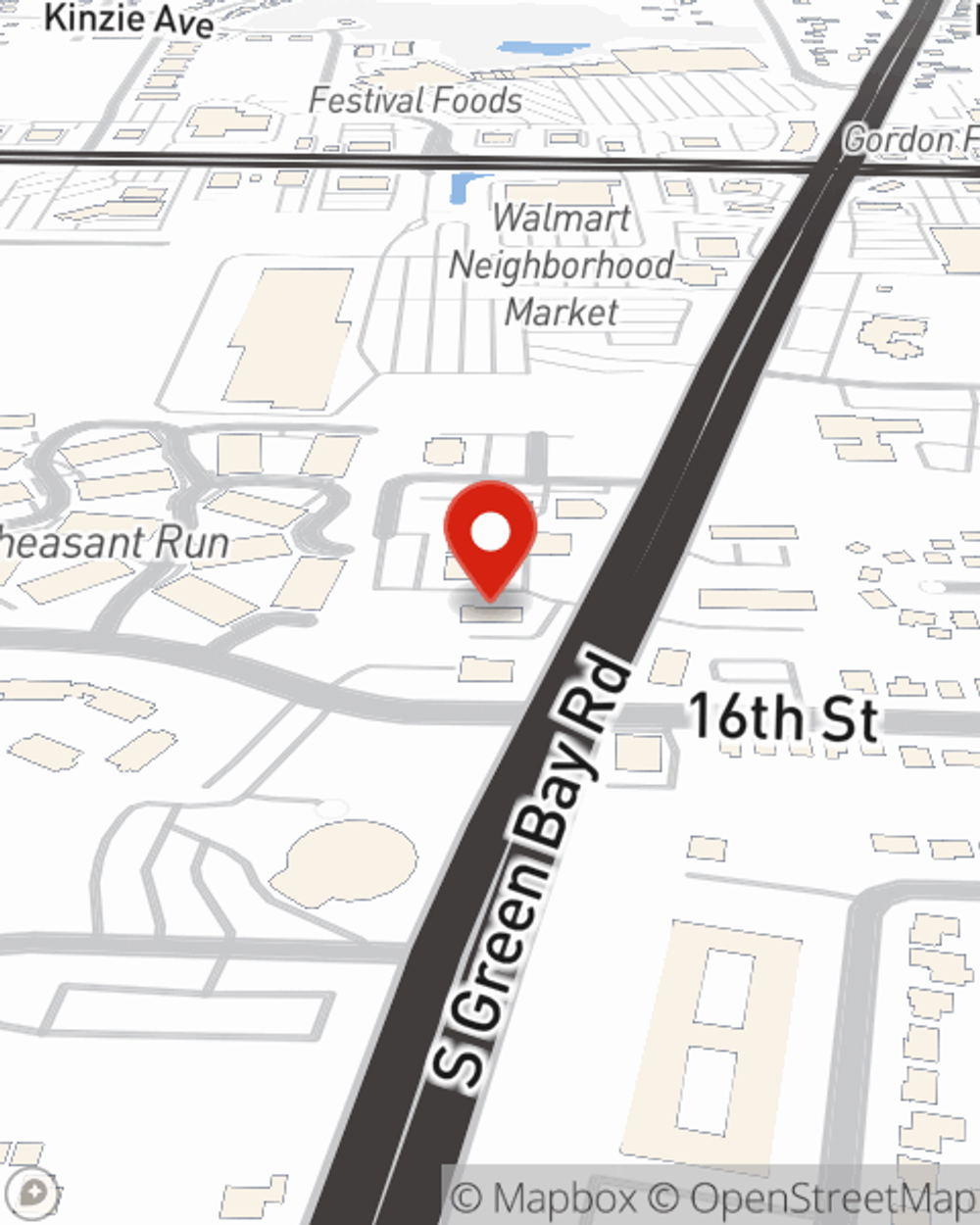

There are plenty of choices for renters insurance in Mt Pleasant. Sorting through providers and coverage options to pick the right one isn’t easy. But if you want economical renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy impressive value and hassle-free service by working with State Farm Agent Brian Ketterer. That’s because Brian Ketterer can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including mementos, musical instruments, sports equipment, jewelry, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Brian Ketterer can be there to help whenever the unexpected happens, to get your homelife back to normal. State Farm provides you with insurance protection and is here to help!

Get renters insurance in Mt Pleasant

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

Renters insurance may seem like not a big deal, and you're wondering if it can actually help protect your belongings. But take a moment to think about what would happen if you had to replace all the belongings in your rented apartment. State Farm's Renters insurance can help when windstorms or tornadoes damage your stuff.

If you're looking for a reliable provider that can help with all your renters insurance needs, visit State Farm agent Brian Ketterer today.

Have More Questions About Renters Insurance?

Call Brian at (262) 631-6100 or visit our FAQ page.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Brian Ketterer

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.